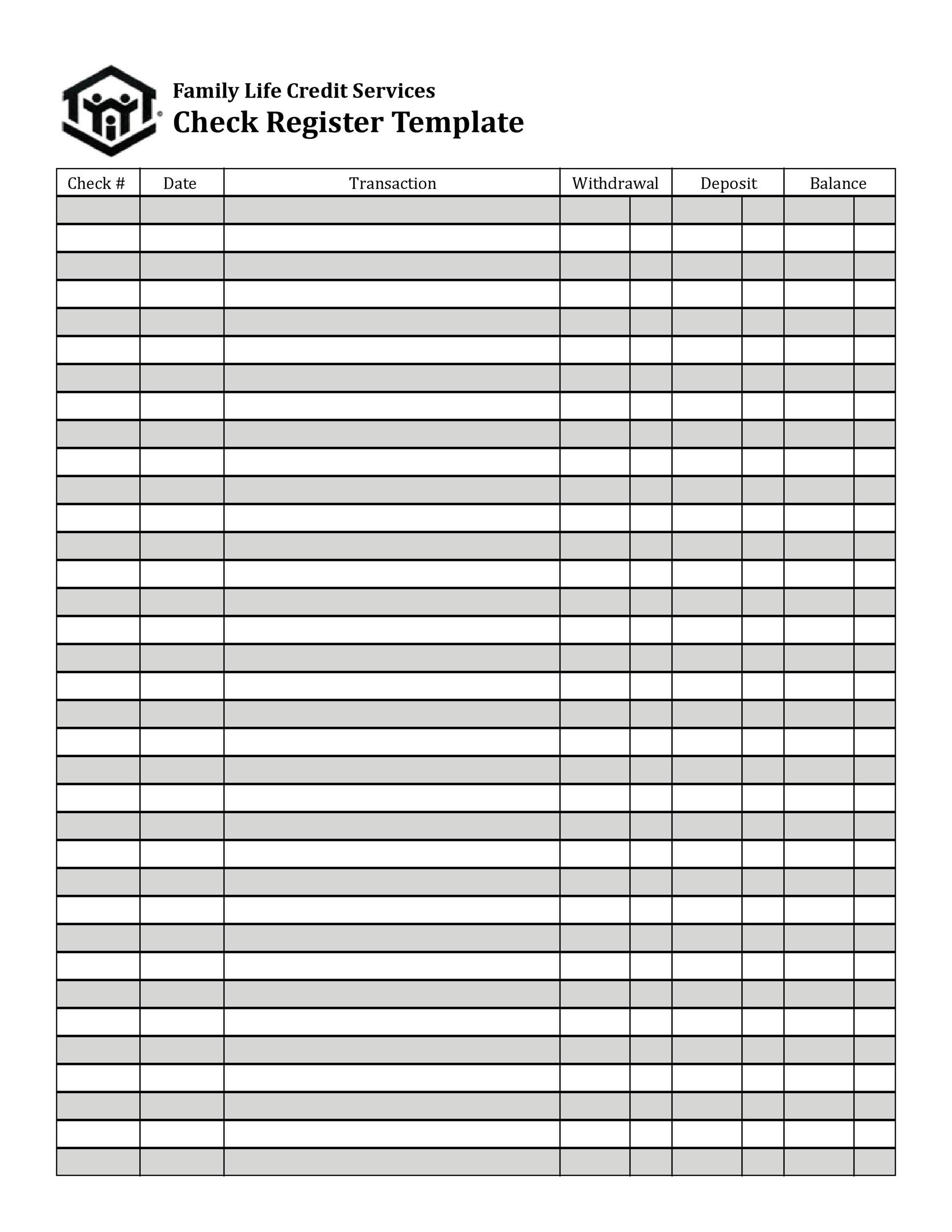

You may also want to check out our Payroll Register Samples. The remaining amount of money in your checking account. This is for transactions where money is added to your account like deposits and interests. This is for transactions where money is taken from your account like payments, withdrawals, and fees. Notes that would describe the event when the check was used. This pertains to the date the check was issued. This is usually found in the upper right-hand corner of the check. A checkbox that you can check off if your check is verified or otherwise.keep track of the amount of money that comes in and out of your checking account.Ī check register would usually have the following fields:.steer clear of the possibility of encountering bounced checks as these can cause additional expenses and further problems, and.easily file a report should there have been cases of identity theft or if you suspect any unusual activity in your account,.compare your records and the bank’s records and identify any mistake,.Our Checkbook Register Samples can help you

It serves as a backup to the records that your bank has and it keeps you updated on the transactions you made to your account. Keeping a record of all your check transactions ensures that you are aware of how much money you have in your checking account.

0 kommentar(er)

0 kommentar(er)